Log in:

> Member

Frequently asked questions

Below are some of the commonly asked questions by members along with their answers.

- What are the requirements to set up a password?

- How do I reset my password?

- What are the key features of website?

- What does Helpline support with?

- How do I contact Helpline?

- What is my current balance, or how do I access my annual confirmation?

- How do I change investment options?

- How do I change my contact details?

- What are the current fees?

- How do I change my contribution amount?

- What is the Scheme’s stance on sustainable investment?

- What financial advice is available?

- When can I access my money?

- What should I do before retiring?

- What are some tools to help me plan for my future retirement?

Website access

Helpline

Savings and account details

Financial advice

Answers

Website access

1. What are the requirements to set up a password?

Complex passwords are the best way to keep your savings account digitally secure.

Password requirements for the log in are:

- At least 8 characters

- A lowercase letter

- An uppercase letter

- A number

- A symbol

- Password can't be the same as your last 10 passwords

CERT NZ recommends long and strong passwords because they are much harder for attackers to crack. They recommend creating a passphrase that is a string of four or more words as it is easier to remember and is stronger than a random mix of letters.

2. How do I reset my password?

You can reset your password online at any time. Visit www.teachersretire.org.nz and click “Log In” shown in the top right of the page. Then click “Forget your password” under the “Log In” button.

To reset your password, or to Activate your account on this site, you require:

- Your member number (shown on your annual confirmation)

- A valid email address and mobile number registered in our system (if you’re unsure what email address and mobile number are recorded please call Helpline)

- Your date of birth

(If you don't have all of the above information, or if you are having trouble using this service, please call Helpline on 0508 4 83224).

3. What are the key features of website?

The website offers a range of features including quick access to your account information, annual confirmations, and your recent activity. You can also source information about the Scheme including newsletters, investment information (for example member booklet, SIPO, monthly investment market commentary as well as download the relevant form), and update your account profile (investment option switches, contact details, communications preference).

Helpline

4. What does Helpline support with?

Helpline is your first contact for any questions about the Teachers Retirement Saving Scheme. They cover a range of different topics including:

- Website account access and password reset;

- Account balance;

- Investment option change;

- Questions about fees;

- Updating contact details and communications preferences;

- Questions on key documents such as annual reports and benefit statements.

5. How do I contact Helpline?

Helpline’s contact details are available here.

Savings and account details

6. What is my current balance, or how do I access my annual confirmation?

Your online account shows your current balance as at the time you logged in. It shows the total balance, and a breakdown of contributions. Additionally, you can access your yearend annual confirmations for prior financial years.

7. How do I change investment options?

You can refer to the Member booklet for information regarding each investment fund.

If you want to proceed with changing your investment option(s), you can do this online at any time. There is no charge for the first investment switch made within the financial year (1 July – 30 June). However, a fee applies for any subsequent changes during the same financial year. You can also make changes to the investment fund(s) by filling and returning the Form 1- Investment alteration request.

8. How do I change my contact details?

Login to your account and edit your personal details. You can also indicate your communications preferences, opting for either email or post.

9. What are the current fees?

Fees may change occasionally so please refer to the helpline for more information.

10. How do I change my contribution amount?

Download, complete and return Form 5 – Application to vary, suspend or restart contributions

To change, suspend or restart your contributions you will need to complete Form 5 - Vary or suspend contributions form which is available on the Documents page, and return to the Scheme Administrator at teachersretire@mercer.com

This form gives you the option to change, suspend, recommence and the option to also contribute to your KiwiSaver scheme. As of 1 October 2016, lump sum contributions to your account are not available for the TRSS.

Contribution changes are confirmed by the MOE via your pay slips by your pay provider - not Mercer.

Please ensure that you put the whole percentage that you want taken from your salary on the form. For example, if your current contribution rate is 5%, but you want to add a further 3%, you will need to write it as 8 percent on the form. The two types of accounts that members can contribute to are the basic and voluntary account. Your voluntary account can be accessed and withdrawn at any time, whereas your basic account has limitations.

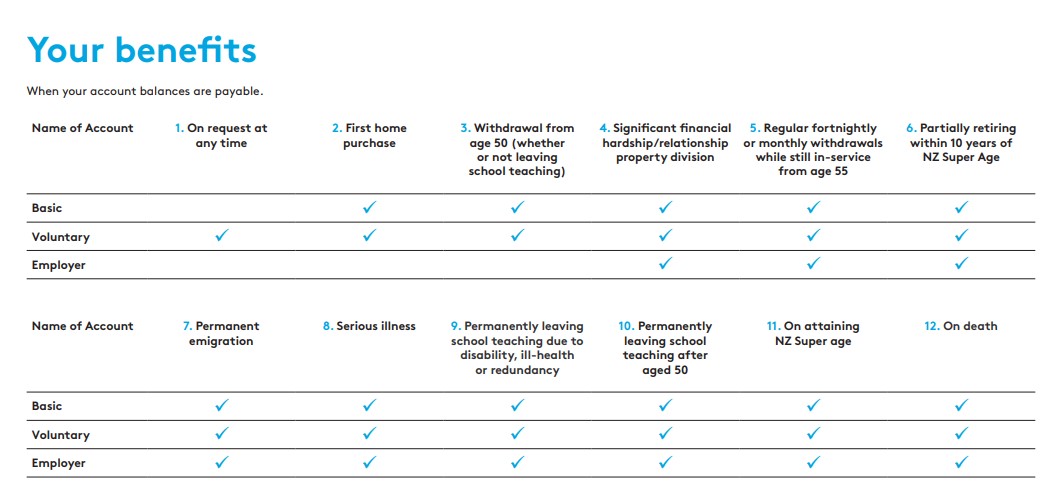

Please refer to the below contribution table for your withdrawal options:

The limit on changing contribution levels is 3 times per year (unless the Ministry of Education approves any further changes).

If you are a subsidised member (i.e. your employer is contributing to the scheme on your behalf), you can choose to contribute any percentage of your salary with a minimum of 1% and any multiple of 0.5%. (For example, 2.5% or 3% but not 2.75%.) Your contributions up to 3% of your salary are allocated to your Basic Account. Contributions in excess of 3% of your salary are classified as voluntary contributions and allocated to your Voluntary Account. If you are an unsubsidised member (i.e. your employer is not contributing to the scheme on your behalf) and you joined your current school on or after 1 July 2007, the minimum member contribution is 4% of your salary. You may contribute more, which must be a multiple of 0.5% of your salary. All member contributions must be made through payroll.

11. What is the Scheme’s stance on sustainable investment?

Your savings are invested by fund managers chosen by Mercer. Mercer has its own beliefs and policies on sustainable investment which broadly align with our own. For example, Mercer has committed to achieving net-zero absolute carbon emissions across its investment funds by 2050*. It does not necessarily follow that the Scheme will achieve carbon net-zero status by this date as this would depend on the specific asset allocation of our fund(s) at the time.

Mercer requires all its managers to assess and reflect ESG risks and opportunities in security or asset selection. As a responsible asset owner, Mercer also expects its managers to seek to improve the ESG practices of the companies they invest in through share voting and engagement. Exclusion is usually a last resort, but a company may be excluded from a portfolio if it is determined that engagement and voting is unlikely to lead to positive change.

Mercer’s commitment to responsible investment is set out in its Sustainable Investments Policy. Mercer has also published a climate change report which sets out its climate-related commitments in more detail. You can view these documents below.

Read more:

· Mercer's Sustainable Investment Policy

· Mercer's 2023-2024 Sustainable Investment Report

*Defined as absolute carbon emissions, per $M of funds under management and Scope 1&2 for the Mercer Investment Trusts New Zealand in aggregate.

Financial advice

12. What financial advice is available?

It is important to seek financial advice from an appropriately licensed financial adviser your to ensure your intended action is appropriate in light of your particular investment objectives, financial situation and needs.

Our financial advice page has a few links to organisations that offer various financial planning and advice services. These are a good starting point.

13. When can I access my money?

Since the primary purpose of TRSS is for retirement, there are restrictions on when withdrawals can be made. Please refer to the Member booklet for more information.

14. What should I do before retiring?

Some things you may want to consider could be:

- Use some online financial planning tools (for example www.sorted.org.nz/tools)

- Read the latest reports from Massey University’s Financial Education and Research Center, as they do studies into what people in retirement typically spend. This may help serve as a benchmark for your financial plans.

15. What are some tools to help me plan for my future retirement?

Sorted.org.nz have a range of different online tools that can help with financial planning for retirement, KiwiSaver, budgeting, home buying, and investing. Visit www.sorted.org.nz/tools for more details.