Rays of hope for markets

As we say goodbye to a difficult 2020, there are some positive signs for the global economy.

An overview of the global economy

The global economic recovery continued into the start of the New Year, despite COVID-19 infections reaching new record levels in the US and across Europe, with new strains emerging in a number of countries.

However, as we say goodbye to a difficult 2020 there are some positive signs; news of an effective vaccine rollout and certainty around the US election result are having a positive impact on markets.

Economists and analysts are predicting global economies to return to pre-COVID-19 levels in late 2021.

Infections surge stalling growth

The spike in new infections in the US is likely to slow economic growth.

Despite the spread of the virus across pockets of the US, December data pointed to signs of a recovery. There was a rise in small business confidence and home building activity, and the unemployment rate fell.

These are modest gains in comparison to China’s solid economic growth. China is expected to be the only major economy in 2020 to see positive year-on-year growth. China’s exports rose and retail sales grew during the year. China also pushed ahead with investment in infrastructure to support new growth sectors such as artificial intelligence, robotics and 5G.

The New Zealand economy has turned a corner

Turning to the New Zealand economy, economic growth was better than expected for the third quarter of 2020, up 14% and returning to pre-COVID-19 levels. Additionally, economic indicators such as business and consumer confidence point towards a strong recovery. This is being supported by New Zealand’s ongoing control of COVID-19 infections.

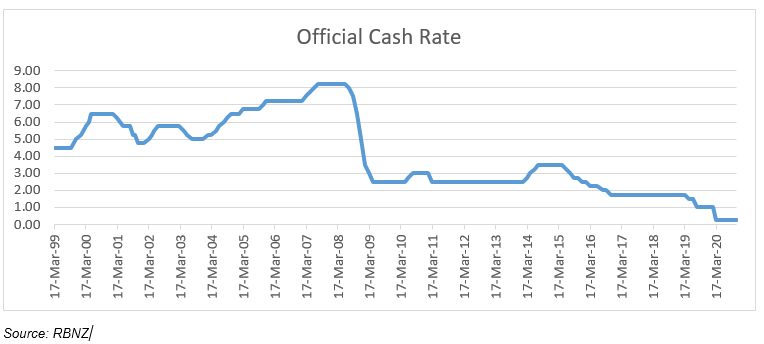

Another supporting factor for the economy is the record low official cash rate (OCR) of 0.25%, down from 1.00% in February 2020. This has helped support businesses and households looking to borrow, but has penalised savers who are reliant on interest income.

The Reserve Bank of New Zealand’s (RBNZ) decision to cut the OCR is in addition to a $100 billion quantitative easing (bond buying) programme that aims to make it cheaper for the government, businesses and households alike to borrow and invest.

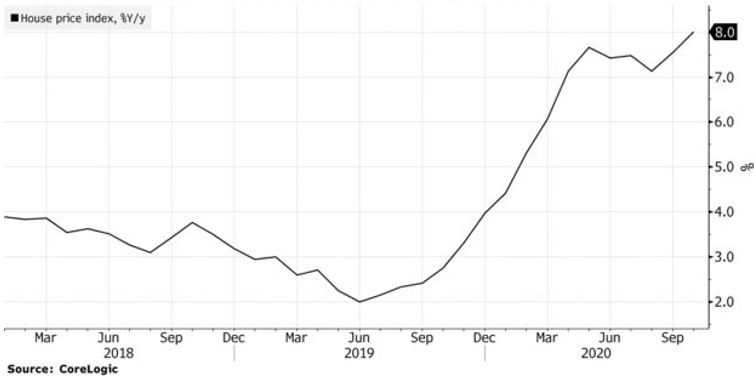

One beneficiary of low interest rates is the housing market. Low interest rates have made home loans more affordable, stimulating demand for properties.

According to CoreLogic data, home values continue to rise despite rising unemployment (5.3% at September 2020) and lagging wage growth (up 0.2% despite the Government raising the minimum wage from $17.70 to $18.90 an hour on 1 April).

Another boost for residential property prices has been the removal of LVR restrictions by the RBNZ in April 2020. However, many commercial banks have begun re-imposing these restrictions, ahead of a potential move by the RBNZ.

A mixed bag for investment markets

Global share markets finished the last calendar month of 2020 on a positive note. Despite political tension in the US and a new, highly contagious variant of COVID-19 spreading throughout the UK, global share markets continued to see inflows as investors gained comfort from the global vaccine rollout.

The Brexit transition period has officially ended and the United Kingdom and European Union have announced the Trade and Cooperation Agreement (TCA). Even with this agreement in place, many uncertainties remain for the relationship going forward. All things considered, global shares returned +3.5% in local currency (+1.7% in NZD).

The New Zealand share market gained +2.6% over the month, benefitting from better than expected GDP data. This is despite the second largest company in the index, A2 Milk, experiencing a -17% loss over the month after cutting its 2021 earnings forecast. Australian shares had a positive month, returning +1.2%, bringing its one year return into positive territory for the first time since February.

The New Zealand dollar strengthened against all major overseas currencies in December except for the Australian dollar (-2.2%). In particular, it continued to strengthen against the US dollar (+2.4%), taking its one year appreciation against the greenback to +6.7%.

Outlook

While the US, Europe and other countries with high infection rates face a dark winter, economists predict brighter times ahead — with a recovery beginning mid-2021 and spanning across a number of years.

We can expect to see governments and central banks continuing to provide support to help promote economic growth.

In a year like no other, the Teachers Retirement Savings Scheme is continuing to take advantage of investment opportunities and manage risks to deliver the best possible outcomes for members.

15 March 2021